Attending both SBC and ICE North America events recently it is clear the US market is still taking shape. And while online and mobile, experience and know-how of regulated markets will all be very important, it is already clear that having strong mobile offerings will determine whether many states’ regulations will succeed in attracting players, says Hervé Schlosser, founder and CEO of Sportnco.

Attending both SBC’s and ICE North America’s sports betting events as delegates and exhibitors over the last four weeks has been hugely productive for Sporntco. We have met new and existing contacts and discussed exciting projects with them, but the events have also been very informative and enabled us to enhance our understanding of how the US market works and the roles the many different stakeholders play in it.

From Sportnco’s viewpoint we are of course keen to sign our first US client and believe that will happen soon. But looking at it from a broader perspective, the market as a whole is developing in many interesting ways just 12 months after the repeal of PASPA. To start with it’s important to remember that the US is not a mature market when it comes to sports betting, especially when it comes to online and mobile channels.

So far only New Jersey has allowed for mobile wagering in its regulation, while other states’ individual histories are not so closely tied with gambling and often will be more focused on retail betting. But for the intra-state markets to grow at scale, remote gaming should be included in any legislation.

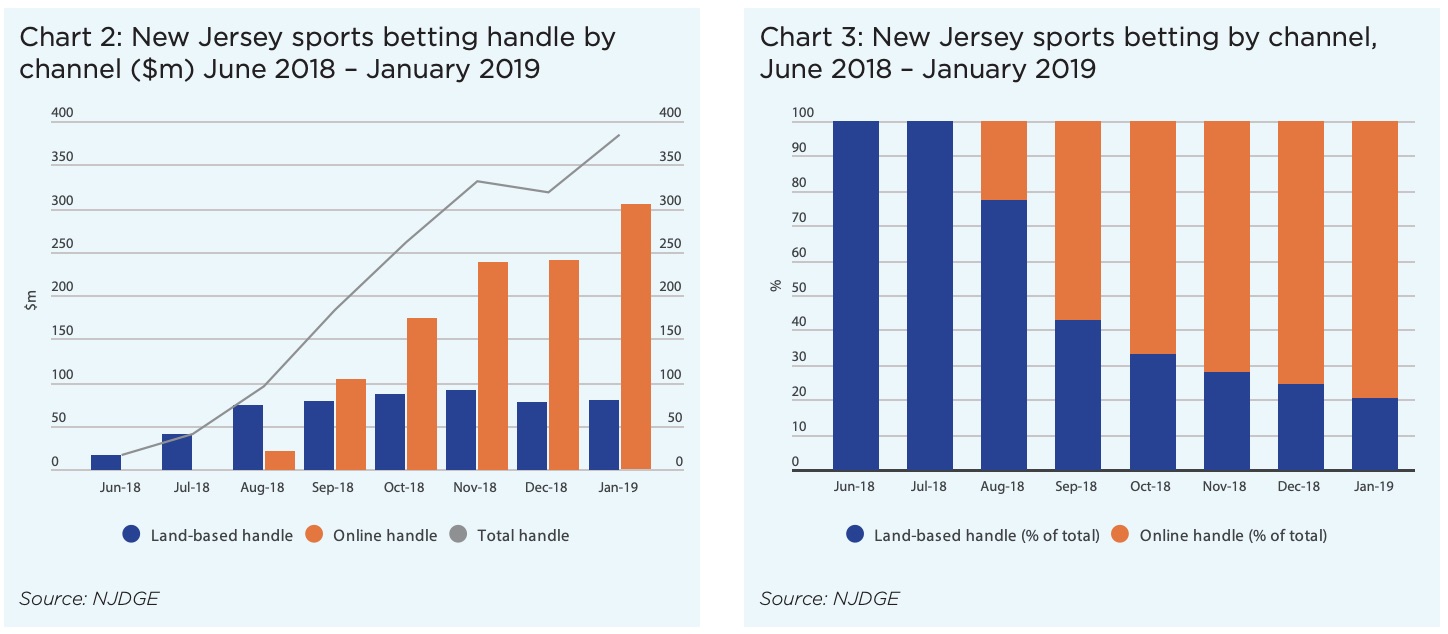

The New Jersey statistics below prove the point as they show online and mobile betting turnover figures and percentage of handle rising consistently throughout 2018-19.

Emphasising this point, Jason Robins, chief executive of DraftKings, recently told iGaming Business: “Mobile has completely changed the model, not just sports. Sport is getting consumed in real time. It means there are opportunities for online betting operators. We view our market as sports fans. And the goal is to create products that will reach as many of those 150 million in the US and 1.5 billion globally.”

Mobile channel will keep growing

And while New Jersey is at the vanguard of that mobile (and broader online) push, other states will be looking with much interest at how betting and gaming are growing across those channels and will extrapolate the kind of revenues and taxes they can generate from them, even more so if the full product suites are available.

Richard Schwartz, president at Rush Street Interactive, made a similar point: “We think mobile first. This is why our mobile experience is a fully functional version of what you see on desktop. While both desktop and mobile options are available in New Jersey, we expect mobile to grow and continue to dominate in terms of usage very soon.”

This augurs well for Sportnco. We have a strong share of market in France and Spain and are active in other European countries where mobile is the leading channel for sports betting. We will be putting this knowledge to use in the US while our experience in trading, risk management and migration projects will bring strong benefits to our future US partners.

Our discussions with our US prospects also show that they are highly sensitive to working with suppliers that operate in fully regulated markets and whose ownership structures are transparent. That is the case with Sportnco and we believe it will play a key role in our US strategy going forward.

It is also worth pointing out that it is not just US casinos or Indian tribes that are interested in online betting and gaming. As the recent Fox Bet news showed, media conglomerates are getting in on the action and other media and marketing agencies will be looking to capitalise on their reach and mainstream audience.

A final and obvious point to make is that the country’s most populous states have still not regulated sports betting. This is because the stakes and potential returns are so substantial in places like California, Texas or New York that all major stakeholders will ensure they get their fair share of the market within a regulatory set up that works best for them.

This once again shows the potential of the US market, which is why as a group Sportnco is optimistic about the US. We have the relevant technology and experience of highly regulated markets to go with an attractive sports offering. So for us the near future is all about signing our first US client, something we believe will be happening in the next few months.

Related article: Blog: As igaming sweeps across the US the market still holds much promise